Japan Web3 Introduction, Taxes, & Laws

Understanding the context of how regulation impacts the development of Web3 in Japan

This post is part of the Japan Web3 Report — the first in a series of APAC Web3 Market reports that aim to bridge the gap between the East and the West in the Web3 ecosystem guiding founders and investors through the intricacies of Asia's crypto-friendly markets. Check out the other ones and subscribe to be the first to get the new insights!

Before diving into specific Web3 trends in Japan, it’s important to understand the history of Japan’s contributions to technological evolution. Japan has been a powerhouse in consumer electronics and hardware, with companies like Sony, Panasonic, Nintendo, and Canon becoming household names worldwide. In addition, Japan has also produced iconic titles and IPs, such as Sonic the Hedgehog, Street Fighter, and Super Mario. Japan was the first country to see its IPs transcend the digital and enter the physical world, evidenced by Pokemon and Tamagotchi.

Despite Japan's leadership in consumer electronics and IP (animation & gaming), it lacks major global social media platforms or prominent internet companies. Japanese companies have often focused on domestic audiences whereas the United States and China have penetrated global markets with Facebook, Google, Tencent, and Alibaba. This absence emphasizes Japan's lag in leveraging digital transformation during the Web2 era.

Beyond technology, Japan faces broader economic challenges driven by an aging population and declining birth rates. These demographic shifts have stifled economic growth, with a noticeable impact on GDP per capita. Despite some recovery post-pandemic, the economic output per person is not on a robust growth trajectory. These challenges underscore the urgency for economic revitalization and transformative solutions, prompting the government’s intervention.

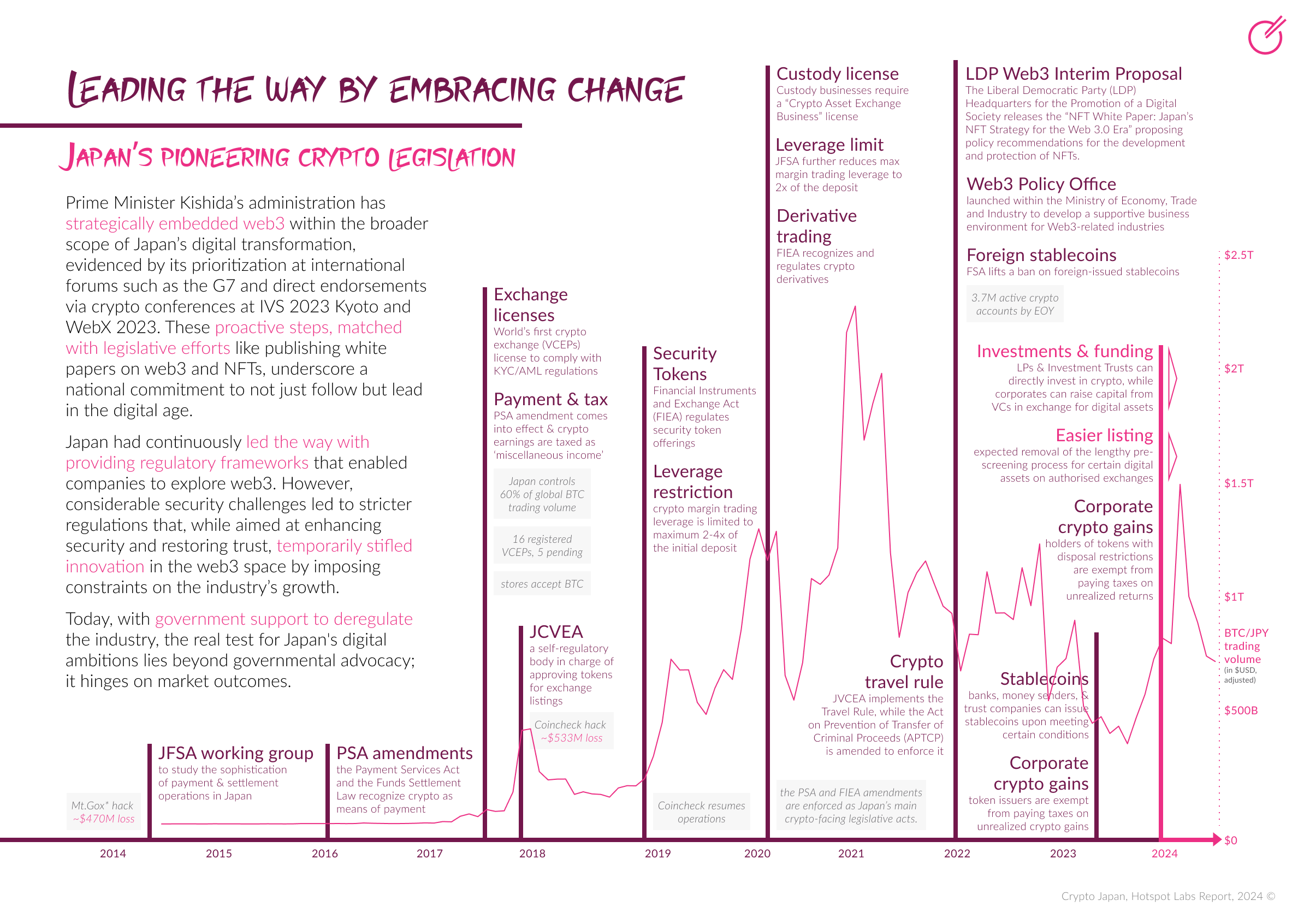

Prime Minister Kishida’s administration has strategically embedded Web3 within the broader scope of Japan’s digital transformation, evidenced by its prioritization at international forums such as the G7 and direct endorsements via crypto conferences at IVS 2023 Kyoto and WebX 2023. These proactive steps, matched with legislative efforts like publishing white papers on Web3 and NFTs, underscore a national commitment to not just follow but lead in the digital age.

Japan had previously led the way with providing regulatory frameworks that enabled companies to explore web3. Examples include legally recognizing Bitcoin and other cryptocurrencies in 2016 under the Japanese Payment Services Act and by introducing the world’s first crypto exchange license in 2017. These steps created a regulatory environment that encouraged local firms like DMM Group and GMO Internet to engage in Bitcoin mining. However, Japan faced considerable challenges as well, including significant security breaches, such as the notorious Mt. Gox hack in 2014. This incident led to stricter regulations that, while aimed at enhancing security and restoring trust, temporarily stifled innovation in the web3 space by imposing constraints on the industry’s growth.

Today, with Prime Minister Kishida's support to deregulate the industry, the real test for Japan's digital ambitions lies beyond governmental advocacy; it hinges on market outcomes.

Tax Regime

Analysis: On an individual level, high taxes deter local consumers from investing and experimenting with cryptocurrencies. For companies, these taxes have posed significant challenges, making it difficult to incorporate in Japan and retain talent. However, the government is actively working to reform tax structures to address these issues.

The Japanese government aims to stimulate innovation innovation by reforming taxes to address the shortage of Web3 startups and talent in Japan. On the supply side, favorable tax policies encourage companies to build in Web3, therefore growing the supply of assets and opportunities.

On the demand side, there are tax reforms to reassure retail investors to invest into Web3 assets and adopt the technology without a significant opportunity cost. However, these tax reforms for retail investors are pending, which has led to another friction point to consumer spending in digital assets. Japan has been prioritizing corporate tax policy reforms. From our conversations with industry leaders, we are anticipating tax reforms in the near future.

The high, one-size fits all corporate and individual tax laws in Japan may have negative implications to Japanese Web3 companies such as:

Reduced Profitability: High taxes reduce a business's net income, leading to lower profitability therefore discouraging entrepreneurship.

Lack of talent: High taxes on businesses can discourage hiring and wage increases. Good talent may also be discouraged to work in Japan due to high individual tax rates.

Capital Flight and Loss of Foreign Investment: Businesses and investors are prone to move their investments and assets to lower-tax jurisdictions to maximize returns.

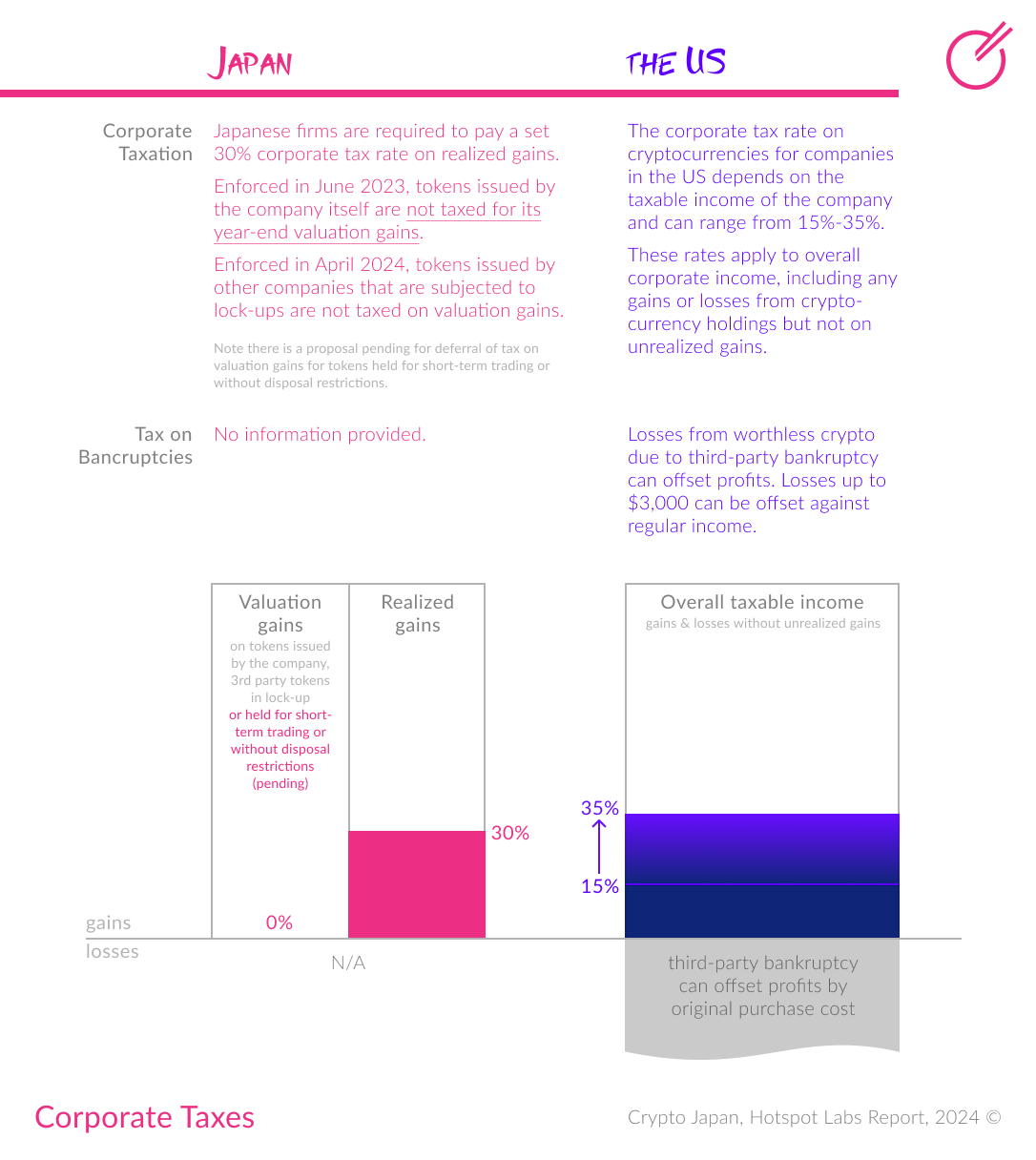

Tax laws are one of the crucial factors influencing where businesses incorporate and how consumers invest. To contextualize Japan’s current unfavorable tax environment, we compare Japan’s with the United States’.

For Individuals:

High-level Summary: The comparison between the US and Japan's tax policies reveals significant differences in market incentives and participation. In the US, lower tax rates, incentives for long-term holdings, and protections for capital losses create a favorable environment for individual investors, driving higher market participation. On the other hand, Japan's higher tax rates on crypto earnings, categorized as miscellaneous income, deter individual investors and can stifle market growth.

For Businesses:

High-Level Summary: In the US, given that corporate tax rates are calculated on taxable income and cryptocurrency holding losses are taken into consideration, companies have more favorable taxes. Companies with less than $75,000 USD in taxable income will be taxed less in the US (15-25%) than in Japan (30%).

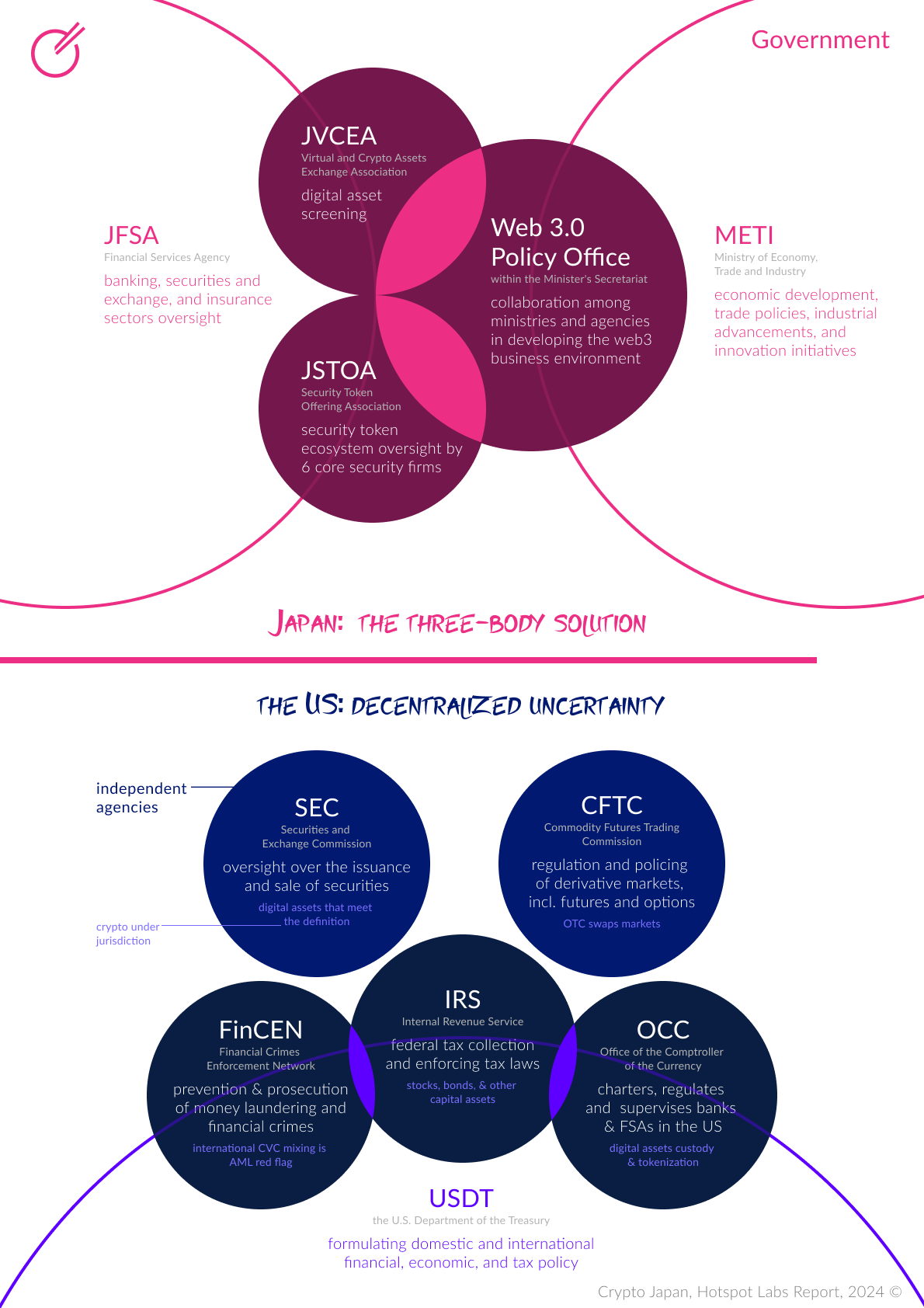

Government Structure

Analysis: Japan employs one centralized agency to oversee both traditional finance and cryptocurrency markets. This unified regulatory model enhances the integration of cryptocurrency into the nation's digital finance sector, while allowing multiple specialized bodies to ensure consumer protection and regulatory clarity.

The Centralized Governing Agency FSA & the Web3 Policy Office

The FSA of Japan, with its dual oversight of traditional finance and the cryptocurrency market, is strategically positioned to lead the integration and regulation of digital assets. Within the FSA's broad framework, various specialized bodies operate, combining governmental insight with industry expertise. These bodies include:

Japan Virtual and Crypto Assets Exchange Association (JVCEA): The JVCEA, formed by leading cryptocurrency exchanges, screens digital assets.

Japan Security Token Offering Association (JSTOA): The JSTOA established by six core Japanese securities firms, including SBI, Nomura, and Rakuten Securities, focuses on spreading knowledge and nurturing the security token ecosystem.

In addition to the FSA umbrella, the Web3.0 Policy Office was established under the Ministry of Economy, Trade and Industry (METI). It is a powerful agency responsible for monitoring the daily operations of the economy. It wields considerable influence over the economy by overseeing exports, imports, investment, pricing, and overall economic growth. Nesting the Web3.0 Policy Office under METI shows the level of commitment Japan is dedicating to promoting Web3.

Japan’s government also welcomes industry expertise to help regulate a newly defined industry. This distinctive approach was mentioned in the 2022 LDP white paper in which the Japan Liberal Democratic Party's (LDP) project team underscored the nation's commitment to fostering a collaborative approach between government and industry.

Comparative Analysis: Japan vs The United States

In contrast, the United States employs a fragmented multi-agency model to regulate various aspects of the financial markets, including cryptocurrency. Moreover, the U.S. has not publicly integrated an industry-led body into policy making and execution. The regulatory landscape is collectively shaped by the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), Financial Crimes Enforcement Network (FinCEN), Internal Revenue Service (IRS), and Office of the Comptroller of the Currency (OCC).

See more in the following sections of the Japan Report or get the full Japan Report pdf!