Japan Web3 Key Players & Adoption

Highlighting key players in the startup & enterprise ecosystem and consumer adoption

This post is part of the Japan Web3 Report — the first in a series of APAC Web3 Market Reports , designed to connect the East and West in the evolving Web3 ecosystem. Our reports aim to guide founders and investors through the complexities of Asia's Web3 markets. Check out the other ones and subscribe to be the first to get the new insights!

Startup Ecosystem

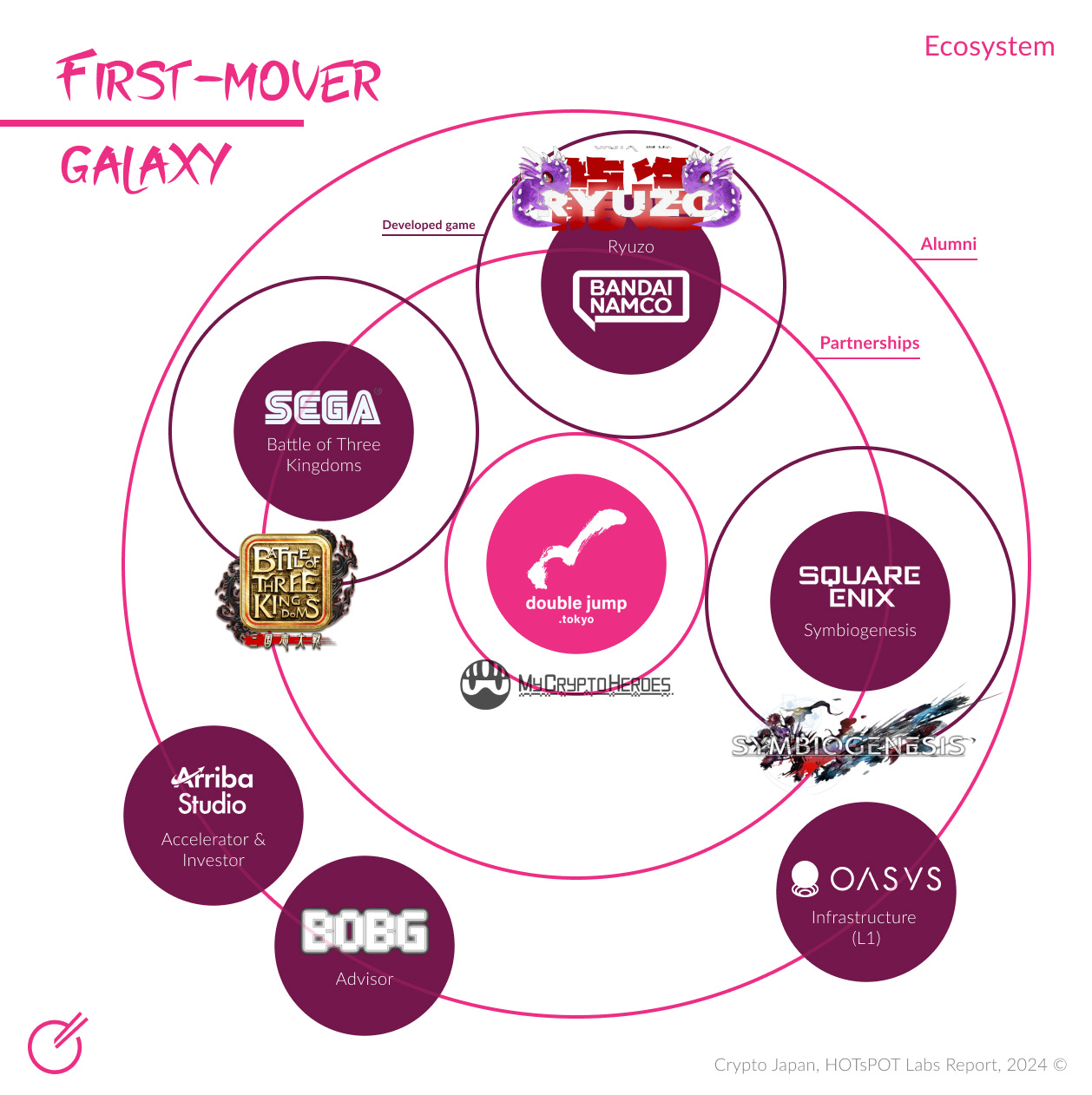

The First Mover

Double Jump Tokyo has played a pivotal role in driving web3 activation in the Japanese market as a developer of blockchain-based games and NFTs. Their flagship game, My Crypto Heroes (MCH), launched in 2019, quickly became Japan’s first major homegrown crypto game. By the end of its launch year, MCH had nearly reached the 100,000 player milestone, with daily active wallets soaring to 3,500. This made it the most popular Play-to-Earn (P2E) project on the Ethereum network that year. As of May 2024, MCH has amassed approximately 25,000 ETH in primary sales. This success has not only solidified Double Jump Tokyo’s reputation but also positioned it as a key advisor for other gaming companies looking to venture into web3.

Today, Double Jump Tokyo has become a key domestic partner for major enterprises venturing into web3, collaborating with giants like Sega on “Battle of Three Kingdoms”, Bandai Namco on “Ryuzo”, and Square Enix on “Symbiogenesis”. Double Jump Tokyo predominantly serves Japanese-based companies, fostering trust as a local partner in an industry. It is common for enterprises to collaborate with local partners due to language and cultural preferences. The expected launch of their games in the coming quarters, or by early next year, will be a true test of their market strategies. It remains to be seen whether they will target domestic Japanese gamers exclusively or leverage blockchain's global reach to innovate new business models and customer acquisition strategies. This will demonstrate whether Japanese companies are fully utilizing blockchain technology to pioneer new business avenues and test innovative market approaches.

Beyond direct game development, Double Jump Tokyo’s influence extends through its alumni, who are spearheading initiatives to boost the ecosystem.

Oasys | Infrastructure — a Japanese blockchain for which Double Jump Tokyo serves as the primary developer

Arriba Studios | Investor & Accelerator — a web3 seed startup accelerator in Singapore

BOBG | Advisor — specializes in token issuance, operations, and management.

Local Chains: Astar Network & Oasys

In Japan, local partnerships are highly valued, and as a result, Oasys and Astar Network have emerged as important infrastructure providers. These blockchains, initially targeting Japanese companies, have opted for collaboration over competition. Astar participates as one of the initial validators on the Oasys Gaming Chain. Oasys primarily focuses on gaming, establishing partnerships with industry giants like Bandai Namco and Sega, while Astar extends its reach to non-gaming sectors by partnering with companies such as Sony and Mazda.

On the global front, companies like Avalanche, IMX, and Polygon are making inroads into Japan. These blockchains have adapted to local market demands by securing listings on Japanese cryptocurrency exchanges and localizing their services through hiring local teams. Notably, Avalanche’s partnership with Playthink on loyalty programs highlights the growing interest of Japanese enterprises partnering with global companies.

Token Listing on CEX

Analysis: For global projects looking to expand into Japan, if the token is already listed on a global exchange, it may be an easier process to get listed on the Japanese local exchanges.

Token listing is one of the key considerations for founders when evaluating whether to enter a new market. Factors such as the likelihood of listing on a local exchange, the timeline of listing and how it aligns with market cycles, and the anticipated trading volume on local exchanges - all of which are cost & benefit analysis that inform global expansion strategies. We researched the top 3 Japanese exchanges: bitFlyer, Coincheck, bitbank. Here are key insights:

The top Japanese exchange bitFlyer does an average of $95.7M USD in 24-hour volume (snapshot taken May 10 2024), which is 3% of $3.14 Billion, the average 24-hour trading volume of global top 5 exchanges

Amongst the tokens listed on top 3 Japanese exchanges, only 6 tokens (ASTR, OAS, MONA, ZPG, PLT, FNCT) are what we consider local, meaning the founding team is Japanese. The total tokens listed range between 27-31 for each exchange, but over 90% of the listed tokens are foreign.

It takes an average of 2 years to get approval to list on a local Japanese exchange.

The misalignment between the growth of Japanese Web3 projects and the lack of local tokens listed on native exchanges poses challenges for both startups and enterprises.

On the supply side, because tokens have been prioritized for global exchange listings, local consumers can not easily access the tokens via local exchanges. Even if Japanese projects succeed in onboarding local consumers, the distribution gap and lack of local accessibility makes it difficult for the consumer demand to reflect on token price.

On the demand side, this further divides the consumer (people who use the product) and the investor (people who invest in the token). The Japanese user base who are using the product and understand the utility of the token don’t have access to purchase the token locally. Versus, the foreign investors who invest in the token via global CEX may not use the product but are purely speculating. Without the core user base and community as token holders, the token price is subjected to high volatility.

“Many enterprises and startups face challenges in getting their tokens listed on local Japanese exchanges. The JVCA guidelines require thorough local checks for domestic exchange listings. To expedite this process, many companies aim to build a global audience first to secure a listing on a global exchange. This approach effectively 'hacks' the process, as market dynamics are fast-paced. Achieving successful global listings can simplify and accelerate approval for domestic listings”

Dominic Jang, CBDO, Vice President of Maplestory Universe,

Former Head of BD at Oasys

Entertainment & Gaming Adoption

Analysis: The wave of Web3 enterprise adoption started in 2021 through investments, IP expansion and infrastructure development. Noticeably many Japanese enterprises from all sectors tapped into Web3 gaming as their first point of entry. Though the sentiment in the Web3 gaming market is that Japan is not bringing its tier 1 IPs on chain.

Gaming Enterprise Adoption

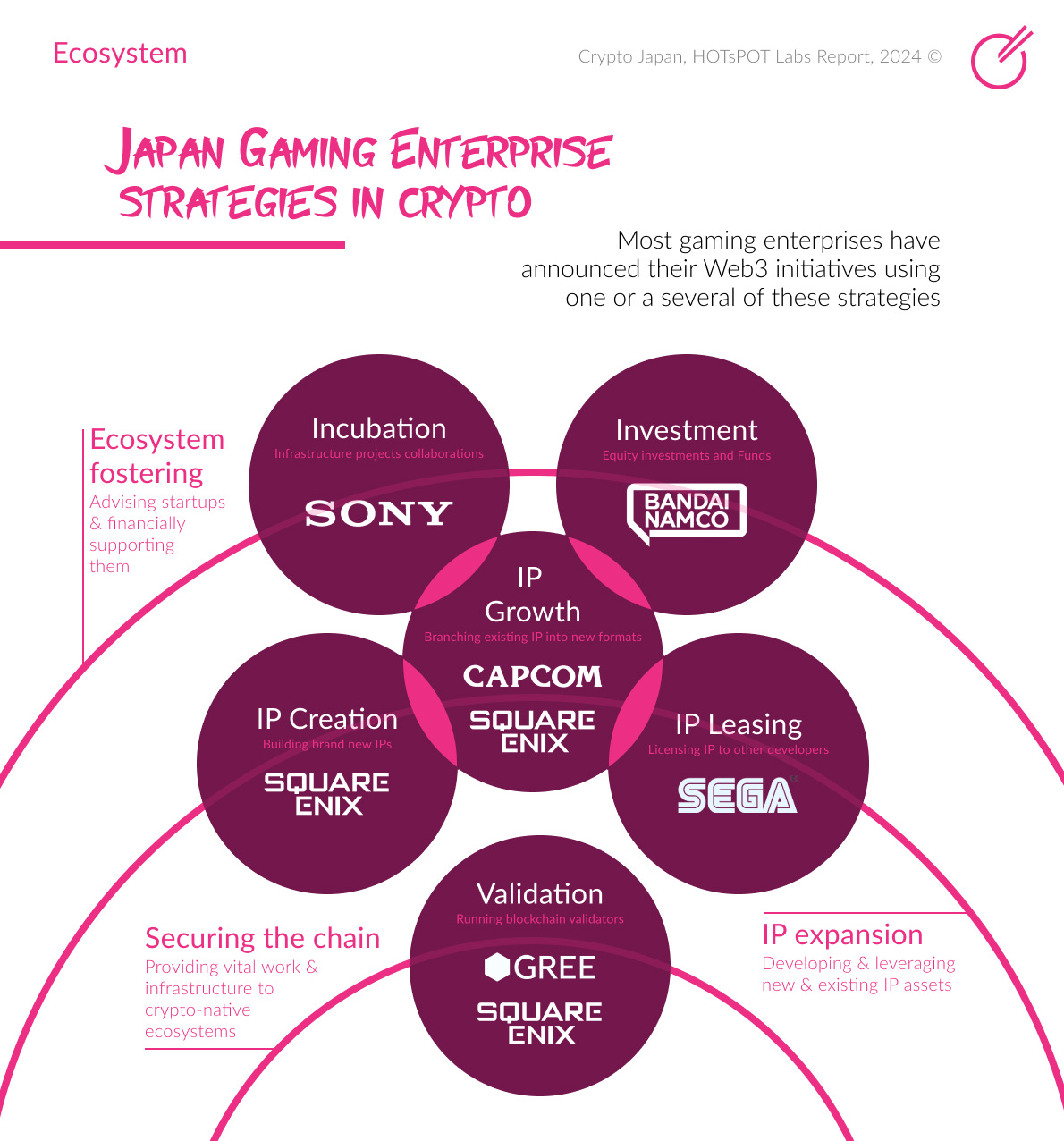

To contextualize Japan’s current Web3 enterprise adoption trends, we look to derive insights from the gaming sector - one of the first movers in Web3 and the country’s largest IP export.

Japan is the third largest gaming market known for its strong gaming culture and innovations in gaming technology. Most gaming enterprises have announced their Web3 initiatives utilizing one or a combination of the following strategies:

Equity Investments: Bandai Namco created “Bandai Namco Entertainment 021 Fund” dedicated to investing in startups with a goal of creating new entertainment and building Bandai Namco’s IP Metaverse (Source DailyCoin). They also invested into Oasys (L1 Protocol) and Gangbusters (gaming studio developing blockchain social games)

Incubation Programs: Sony created a Web3 Incubation Program with Astar Network (L1 Protocol) to provide mentorship and financial support to startups building on the network.

Build New IP: Square Enix launched Symbiogenesis, "a web-based, narrative-driven platform" leveraging blockchain technology.

Grow Existing IP: Capcom released Street Fighter NFTs on WAX (Source Cointelegraph). Square Enix is selling Final Fantasy VII collectibles with digital copies and certificates sold as Polkadot-based NFTs.

License IP to Others: Sega licensed its Virtual Fighter games IP to NFT firm OASYX for a 1K NFT collection to be used in a future metaverse game (Source VCG) and another “immensely popular” IP to Line Next for its blockchain gaming platform Game Dosi (Source VCG)

Become Blockchain Validators: Both GREE and Square Enix are validators of the Oasys Blockchain. GREE is also a validator of the Avalanche Blockchain, on which it will build its first blockchain game. (Source Avalanche)

When speaking to these gaming enterprises, there is a common narrative in answering “why Web3”. The narrative is a logical deduction of company painpoint, market opportunity and industry expertise.

Company painpoint: Intellectual properties (IPs) can create new revenue streams by leveraging their brand, content, and audience loyalty. Most top Japanese gaming IPs have already branched the most tangential channels such as animation, merchandising, publishing. To further grow its revenue, Web3 is often seen as a new revenue stream.

Market Opportunity: Many enterprises still refer to Axie Infinity as a prominent case study to analyze the Play-to-Earn business model that led to its quick adoption and profitability - at its height of 1M DAU and $9B market cap. (Source Naavik)

Industry Expertise: Japan is the third largest gaming market with 6 of the top 20 global gaming companies by market cap. (Source CompaniesMarketCap) These credentials became their source of confidence in dominating the Web3 gaming market.

In addition to sharing common narratives and strategies, these gaming enterprises also share external local advisors to aid their market entry. Strategic local advisors like Double Jump Tokyo, mentioned earlier in the paper, work with enterprises for example Sega and SquareEnix and DeFimans works with DMM. These advisors provide support on regulatory guidance, blockchain infrastructure research, tokenomics design to Japanese / English translation. Together, the gaming IP powerhouses and their strategic partners aim to penetrate the Japanese home market and adapt to the global stage.

Aligning with the global trends, Japanese gaming is a common first point of entry into Web3. In Q3 and Q4 of 2024, there will be a handful of Web3 games launching. However, through our conversations with these developers, the target demographic is still US and SEA players.

Not only are traditional gaming companies competing to dominate the Web3 gaming space, other industry players are also venturing in to get a slice of the pie. For example, Honda is collaborating with Darewise Entertainment, a subsidiary of Animoca Brands to co-develop new gameplay and game assets for Lif\e Beyond, a AAA MMO game built on Bitcoin ordinals.

Non-Gaming Web3 Applications

Over 15 Japanese enterprises encompassing 28 affiliates have announced its Web3 strategy ranging from building infrastructure (native chain) to consumer products (wallet, exchanges, NFT marketplace). Abstracting away from gaming, other interesting blockchain applications include:

Financial conglomerates building in DeFi: SBI Holdings creating cryptocurrency exchange 'BitPoint' and lending service 'HashHub Lending'. MUFG Financial Group creating digital asset issuance platform 'Progmat' to launch stablecoins.

Telecommunication operators building consumer DApps: KDDI Group operating Web3 wallet service 'αU Wallet' and NTT Group operating Web3 wallet service 'Scramberry'.

Automobile conglomerates building RWA and solving supply chain: Toyota announcing its plans to tokenize vehicle contracts and instill ‘value digitalization’ by sharing information on the manufacturing, shipping, and selling of parts to long-term stakeholders.

IT companies developing API infrastructure for blockchain computing: Fujitsu, launched a Web3 Acceleration Platform, which provides a dev environment including APIs for blockchain and high-performance computing. It has been running a year-long pilot program with the Asian Development Bank (ADB) to verify the safety of cross-border transactions using blockchain.

Entertainment companies collaborating with consumer DApps to monetize prominent IP: Sanrio, the owner of Hello Kitty, announced a collaboration with Gaudiy, a Web3 fan platform, to launch an SNS service based on Arbitrum and GPT-4 in 2024, utilizing Sanrio’s intellectual properties

To summarize, there are many press releases announcing Japanese enterprises venturing into Web3. However most initiatives are still in the early exploration and research phase, while some trailblazers are in the process of iterating to find product market fit. It remains to be seen how resilient enterprises will be in continuing their Web3 investments upon encountering challenges like community backlash, lack of strong revenue and market downturn. While some projects have rolled back their Web3 announcements (eg. Sega announced an NFT project in April 2021 but stalled due to backlash from fans), some have successfully launched and actively collecting datapoints (eg. Square Enix successfully launching Symbiogenesis in November 2022 and accumulated a total of $23K USD in NFT trading volume at time of writing.) We pose questions on enterprise’s motives in Web3 - if purely profit driven, the entity is likely to claw back initiatives in response to bear market cycles; if the use case solves a pain point, the entity will likely focus on adoption numbers to further inform R&D investments.

Consumer Adoption

Analysis: Japan is a cash heavy economy standing at 4-7% consumer crypto adoption rate, less than half of the global average rate. The low adoption rate is influenced by several factors including an overall conservative investment mindset, previous hacks, and high taxes.

Data on Japan’s crypto consumer adoption suggests a cautious approach. This conservatism is a product of the external environment and the internal nuances of Japanese culture. External factors like past crypto hacks and the current high taxation creates the logical barrier for consumers to participate in crypto. While on a deeper cultural level for each individual, factors like language-barrier, financial literacy and lack of trust for non-localized foreign companies creates the emotional barrier for consumers to invest.

“If non-Japanese projects do not localize their marketing efforts in traditional Japanese, local consumers often lack the trust to participate. It is important to understand that Japanese people value consistency and are generally resistant to change. Therefore, localization and finding local partners are critical for overseas projects aiming to break into the Japanese market.”

Shota Iwasaki, CEO of Pacific Meta

Data sources report different levels of Japanese consumer crypto adoption ranging from 4% to 7% but well below the global average of 15% as of 2022 (Source). Japan ranks No.18 on The 2023 Global Crypto Adoption Index (Source). This low crypto adoption is a symptom of its root cause: Japan’s cash heavy economy. A 2018 report indicates that Japanese households had JPY 1,860 trillion (roughly USD 17 trillion) in total financial assets; over 50 percent was held in cash. (Source) Throughout our experiences in Japan, most payments are limited to cash outside of metropolitan cities like Tokyo and Osaka.

There are overwhelming amounts of data to show Japan’s lack of adoption in digital payments and by extension cryptocurrency. But who are these crypto adopters in Japan’s heavily cash-based economy?

According to a study published on Journal of the Japanese and International Economies (source) in December 2020, crypto owners are more likely to be male, aged below 30 years, have higher pretax income, work in private or public companies, or be self-employed, and be graduate-school graduates compared with non-owners. The strongest piece of evidence points to the correlation of adopting non-cash payment methods and crypto. The ratio of crypto-asset owners among Credit card users, Electronic money users, Debit card users, and Mobile payments users is 11%, 12%, 28%, and 22%, respectively. The study’s data show that consumers who use debit cards and mobile payments via smartphone are more likely to use crypto assets. By this correlation, given that less than 12% of Japan’s consumers use E-wallet payments (Source), we draw the conclusion that Japan is not primed for mass crypto adoption.

See more in the other sections of the Web3 Japan Report!