Japan Web3 Investment Landscape

Dissecting key investors and fundraising strategies in Japan's Web3 Ecosystem

This post is part of the Japan Web3 Report — the first in a series of APAC Web3 Market Reports , designed to connect the East and West in the evolving Web3 ecosystem. Our reports aim to guide founders and investors through the complexities of Asia's Web3 markets. Check out the other ones and subscribe to be the first to get the new insights!

Japan stands as the world’s third-largest economy, yet its venture capital (VC) market remains relatively small. In 2023, Japan's entire VC market raised approximately $5.5 billion, which is about one-seventh the size of the San Francisco Bay Area's VC market, highlighting the significant gap and potential for growth. The investment landscape is primarily composed of Corporate Venture Capitals (CVCs), Japanese Financial Institutions (FIs), and a small percentage of independent venture capital (VCs). Historically, investments in startups have focused on domestic consumer-oriented companies because it was seen as safer bets. However, this may change in the next few years. The government is actively working to foster the startup ecosystem and has pledged to increase startup investments to 10 trillion yen ($71.5 billion) by 2027. A part of this pledge is to increase the number of Web3 startups in Japan. This environment offers new opportunities for funding and growth, although it will take time for change to materialize.

In Japan, we’ve seen a notable increase in Web3 investments. This is a response to the government’s progressiveness and openness to foster Web3 development in Japan. In February 2024, the Cabinet approved the bill to allow domestic VCs to invest into crypto assets. As regulatory frameworks begin to adapt, major enterprises are leading the growth of Web3 with strategic investments in the sector.

Key trends currently shaping Japan’s web3 investment environment

1. Significant investments from corporate venture groups

SBI Holdings: Launched a $663 million fund focused on Web3, AI, and metaverse startups, aiming to invest in 150-200 companies.

Bandai Namco: Established the Bandai Namco Entertainment 021 Fund, targeting global startups that leverage blockchain, VR/AR/xR, and AI in entertainment. This fund aims to capture innovative developments at the intersection of technology and entertainment

2. Strong investment preference towards domestic startups

The majority of VCs and CVCs show a strong preference for domestic startups. This trend is driven by the feasibility of public listings on stock exchanges at relatively lower valuations, starting at $50 million, and the language barrier, as most communications in Japan are conducted in Japanese.

What does this mean for US startup founders?

For Web3 startup founders looking to raise funds and explore expansion opportunities, Japan’s investment landscape presents a challenging environment unless they have a guide to help them navigate the market.

Opportunity

Find Strategic Investors with Enterprise Partnerships: This is an effective strategy to localize by working with Japanese enterprises interested in adopting Web3. An example is SBI Holdings, which has invested in Circle and formed a partnership to facilitate the expansion of USDC stablecoin into the Japanese market.

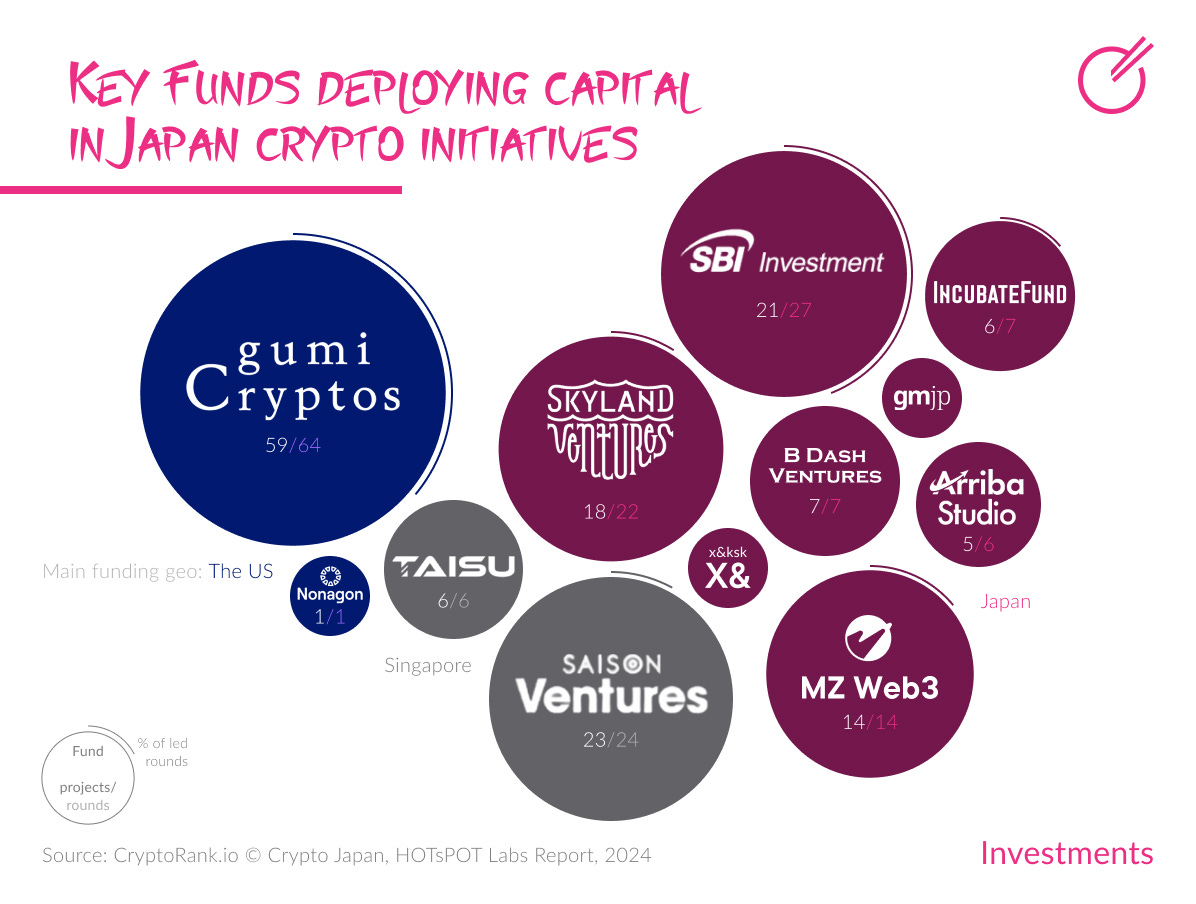

According to our sources, the main funds currently deploying capital in Japan are SBI Investment, Gumi Cryptos, MZ Fund, Incubate VC, Skyland Ventures, Arriba Studios, Nonagon Capital, GM JP, X&KSK Fund, Taisu Ventures, BDash Ventures, and Saison Ventures.

Challenges

Japanese Investors Favor for Domestic Investments: Though there are a few global deals, this investment preference restricts opportunities for foreign startups.

Business Communications are Conducted Mostly in Japanese: This poses significant challenges for non-Japanese speaking teams since English proficiency is low in Japan.

Japanese Enterprises Have Long Decision Making Processes: Enterprise decision-making can be slow, which could cause delays in closing their fundraising rounds.

What does this mean for US VCs?

With the government’s recent authorization for venture capitalists to invest in crypto assets, traditional Web2 VCs in Japan are increasingly interested in this new industry. US VCs that are proficient in Japanese have an advantage in these critical times to

Educate traditional Japanese VCs on how to invest in a new asset class.

Attract limited partners (LPs) from Japan who are interested in global deals but prefer to invest through funds adept at navigating both the Japanese and global ecosystems.

Establish partnership with local VCs and enterprises. US VCs proficient in Japanese can leverage extensive local knowledge and networks to guide portfolio companies to enter or expand in the Japanese market.

Japanese Enterprises fundraising in the Web3 Space

“The sentiment among venture capitalists for investing in Japanese enterprises is driven by a combination of opportunistic timing and Japan’s strength in intellectual property. We are optimistic Japan’s removal of taxes on unrealized crypto gains will lead to a significant rise in altcoin investments, which will help boost domestic crypto projects much like the success WeMade and Klaytn experienced in Korea 2018-2019. Along with favorable macroeconomic conditions, this period offers a unique opportunity to access top-tier IPs and innovative teams at an early stage”

Andy Ahn, Investment Manager at Planetarium Labs

The Japanese government’s push toward deregulation and digital transformation has significantly encouraged both private and public companies to explore and expand into Web3. Some of these companies would attempt to fundraise through token-only rounds to preserve equity.

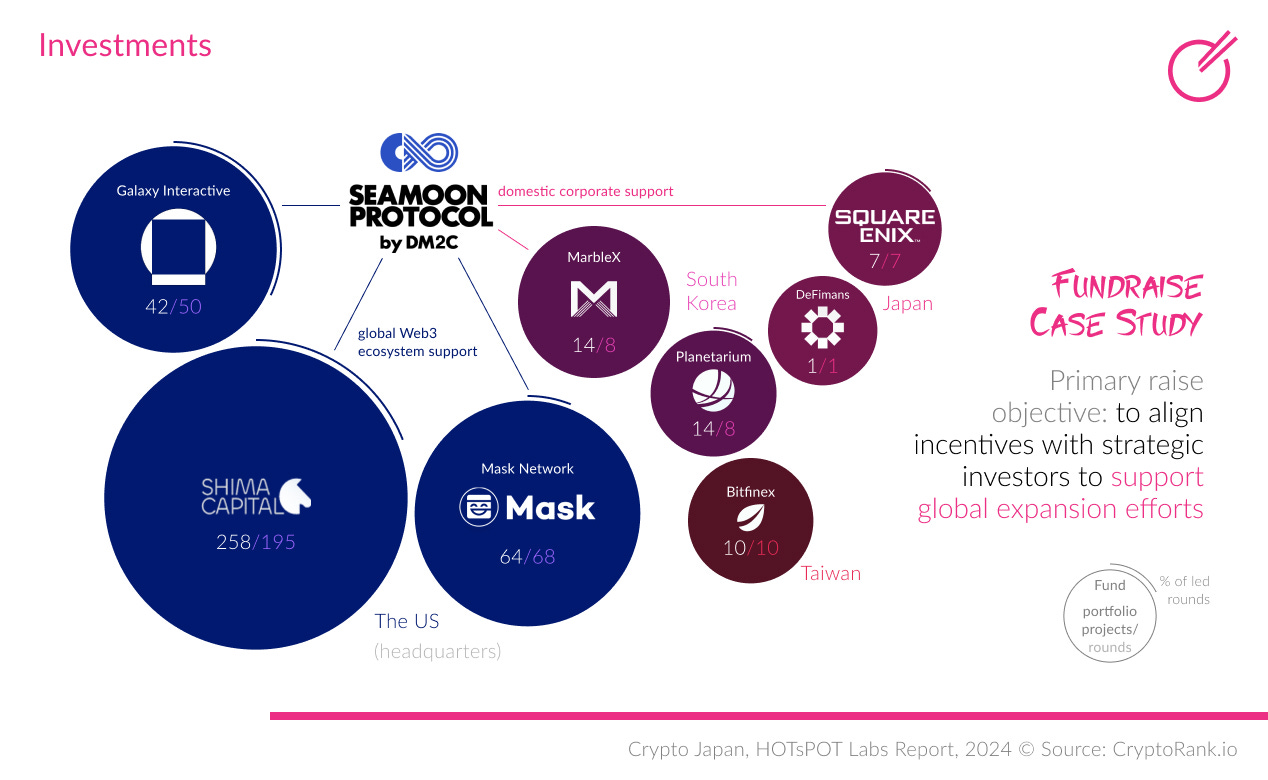

This approach is not new; Korean gaming companies were pioneers in raising substantial funds for their Web3 subsidiaries. Noteworthy enterprises including Kakao with Klaytn, WeMade with WeMix, NetMarble with Marble X, and Com2Us with Xpla, have set precedents.

Case study: DMM.com

This fundraising trend gained traction in Japan around 2022 and 2023. A prime example is DMM.com, which established DM2C Studio co. (Seamoon Protocol), its web3 subsidiary aimed at building an L2 for blockchain games and NFT projects. DM2C Studio raised $2.3 million through a token sale.

One of the primary objectives of DM2C Studio’s fundraise was to align incentives with strategic investors to support their global expansion efforts. This reflects a shift in strategy among traditional Japanese enterprises. While aiming for global reach, DM2C studios continues to engage local expertise by partnering with DeFiMans, a domestic advisory firm.

Enterprises’ Complexities

1. Publicly traded companies can not hold tokens on their balance sheet

Japanese enterprises face regulatory challenges that prevent them from holding tokens directly on their balance sheets due to restrictive financial regulations and unclear tax guidelines. This has led to:

Rise of Third Party Asset Managers to Manage Tokens: To circumvent restrictions on holding digital assets, enterprises rely on third-party asset managers like BOBG. These asset managers hold and manage tokens on behalf of the enterprises, allowing for indirect participation in the Web3 ecosystem. However, this arrangement introduces risks, as enterprises do not have direct control over the tokens.

Auditing Challenges for Digital Assets: The lack of clarity in tax guidelines has made auditors, such as PWC, cautious about auditing companies holding digital assets.

Token-to-Fiat Revenue Conversion: When tokens managed by third-party asset managers are converted into fiat currency, this is recorded as revenue on the enterprise’s balance sheet, adhering to established financial reporting standards.

2. Token Alignment & Value Accrual

The approach to token economics varies between publicly listed and private companies:

Handling Tokens in Public and Private Companies: Currently, publicly listed companies are unable to hold tokens directly on their balance sheets, which has led to the emergence of third-party asset managers. These companies can only recognize revenue from tokens once they are sold in the market. In contrast, private companies can hold tokens on their corporate balance sheets, allowing them to benefit from any increase in token value without needing to sell.

Misaligned Incentives in Web3 Subsidiaries: Frequently, the teams part of the web3 subsidiary do not receive tokens, which can have misaligned incentives between developers, the company, and the token holders.

What does this mean for oversea investors?

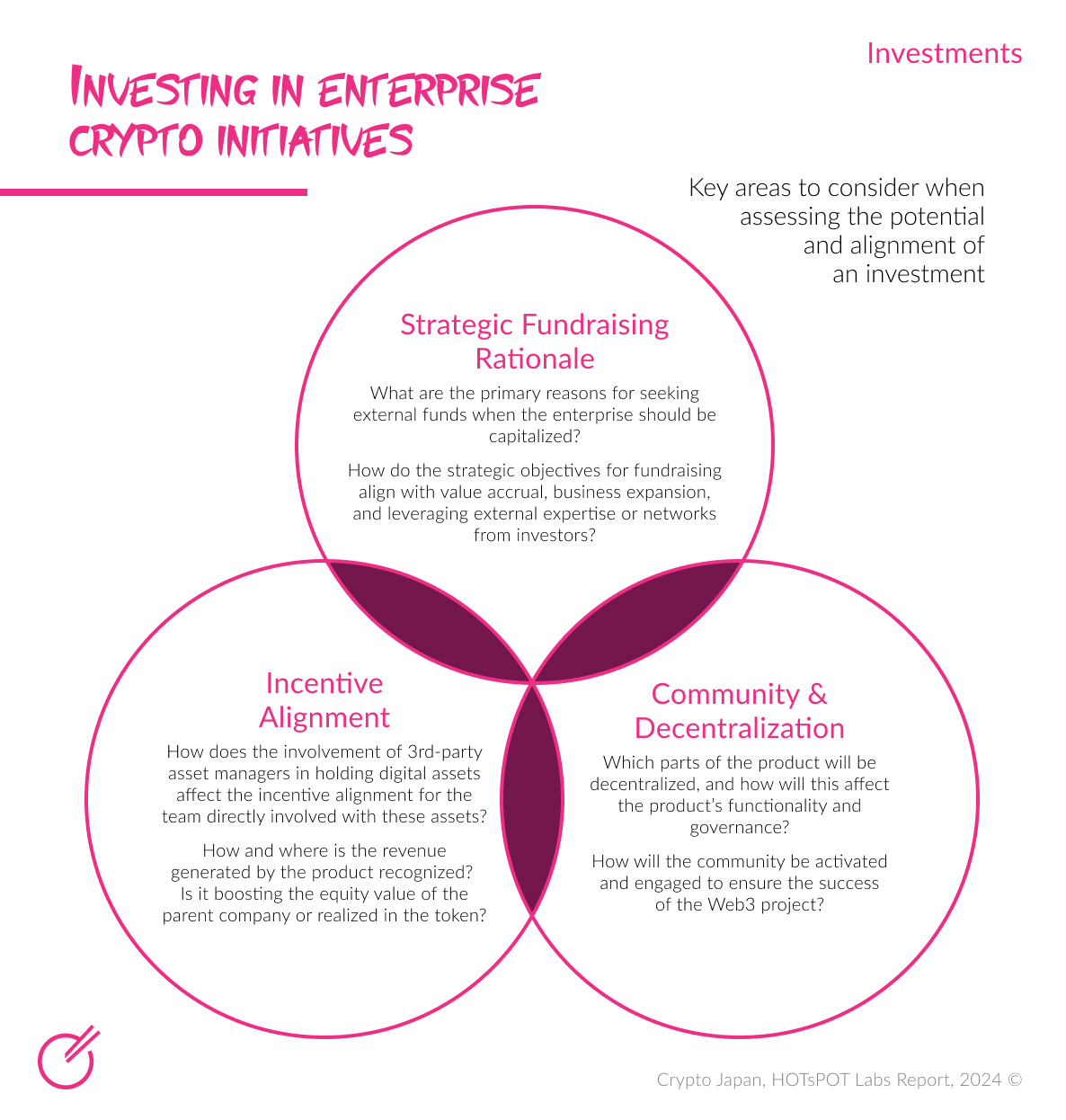

For investors considering investing into enterprise web3 operations, several key question can help assess the potential and alignment of an investment:

Strategic Fundraising Rationale:

What are the primary reasons for seeking external funds when the enterprise should be capitalized?

How do the strategic objectives for fundraising align with value accrual, business expansion, and leveraging external expertise or networks from investors?

Incentive Alignment:

How does the involvement of third-party asset managers, such as BOBG, in holding digital assets affect the incentive alignment for the team directly involved with these assets?

How and where is the revenue generated by the product recognized? Is it boosting the equity value of the parent company or realized in the token?

Decentralization and Community Engagement:

Which parts of the product will be decentralized, and how will this affect the product’s functionality and governance?

How will the community be activated and engaged to ensure the success of the Web3 project?

See more in the other sections of the Japan Report!